Reliance Bulk Recruitment 2023 Are you looking for ways to sell insurance and gain rewards? Look no further; become a Reliance insurance agent today! At Reliance General Insurance, we offer quick and easy market access along with promised rewards.

Join the Reliance General Insurance Partner Program and become a part of one of the largest business conglomerates in the world. With us, you can access our wide range of insurance products and take them to the masses.

For More Detailed Information CLICK HERE

👉Latest Today “06.09.23 Update” Private & Government job👈

| Department Names (Govt & Private) | How to Apply (Video + Details ) Link 👇 | Posting Names | Qualifications |

| விழுப்புரம்,கோயம்புத்தூர், தருமபுரி,கடலூர் மாவட்ட வனத்துறை ஆட்சேர்ப்பு 2023 ( Data Entry Jobs , Office assistant Jobs | CLICKHERE | ( Data Entry Jobs , Office assistant Jobs | 10th Pass , ITI , Diplamo , Anydegree |

| 10,000 புது Clerk வேலை😱 SBI Bankஇல் 2023🔥 | CLICKHERE | Clerk SBI BANK | 12th / Any Degree |

| Phonepe – Apply பண்ணி 3 நாட்களில் Work From Home வேலை🔥3000க்கும் மேல் காலியிடங்கள் | CLICKHERE | DATA ENTRY JOB FROM PHONE PE | 12th Pass Only |

| Amazon Chat Job For Students 4500+ காலியிடம் 30,000 சம்பளத்துடன்🔥Work From Home வேலை | CLICKHERE | CHATTING SUPPORT TAMIL | 12th Pass / Diplamo |

| 12th Pass🤩வீட்டில் இருந்து Typing செய்யும் வேலை🔥 | 7200 Vacancies | Best Work From Home Job | CLICKHERE | Associate | 12th Pass / Diplamo |

| விண்ணப்பித்த அனைவர்க்கும்🤩கை மேல வேலை🔥12th Pass போதும் | Best Work From Home | CLICKHERE | Analyst, Customer Development. | 12th Pass Students,Housewife, Any Degree Candidates |

| IndiaMART Part Time Job🔥Tamil Customer Support Job 😍| Online Jobs At Home | Work From Home Job | | CLICKHERE | Customer Service role for Females only | 10th Pass Any Degree Candidates |

| TATAவில்🤯புதிதாய் வந்த Internship வேலைவாய்ப்பு 2023🔥25,000 Salary TCS | CLICKHERE | INTERNS | 12th Pass Only |

| உங்களுக்கு தமிழ் பேச தெரியுமா?😱30,000 சம்பளத்துடன்🔥காத்திருக்கும் Work From Home வேலை | | CLICKHERE | CIC (Certified Internet Consultant) Role. | 10th to Any Degree |

Notification & Application & Study Materials எடுக்கத் தெரியவில்லை என்றால் இந்த வீடியோ பாருங்க 👉👉👇👇 : https://youtu.be/aIJ8nvm8KLw

நீங்க ரொம்ப நாள்ள கேட்ட RESUME எப்படி MAKE செய்ய வேண்டும் Video Link

👉 (RESUME இப்படி இருந்த வேலை தேடி வரும் )👈

| எப்படி ( RESUME Make ) செய்ய வேண்டும் முழு Video Link 👉 | CLICKHERE |

👇 HERE YOU CAN JOIN OUR SAI VIKRAM ACADEMY FAMILY👇

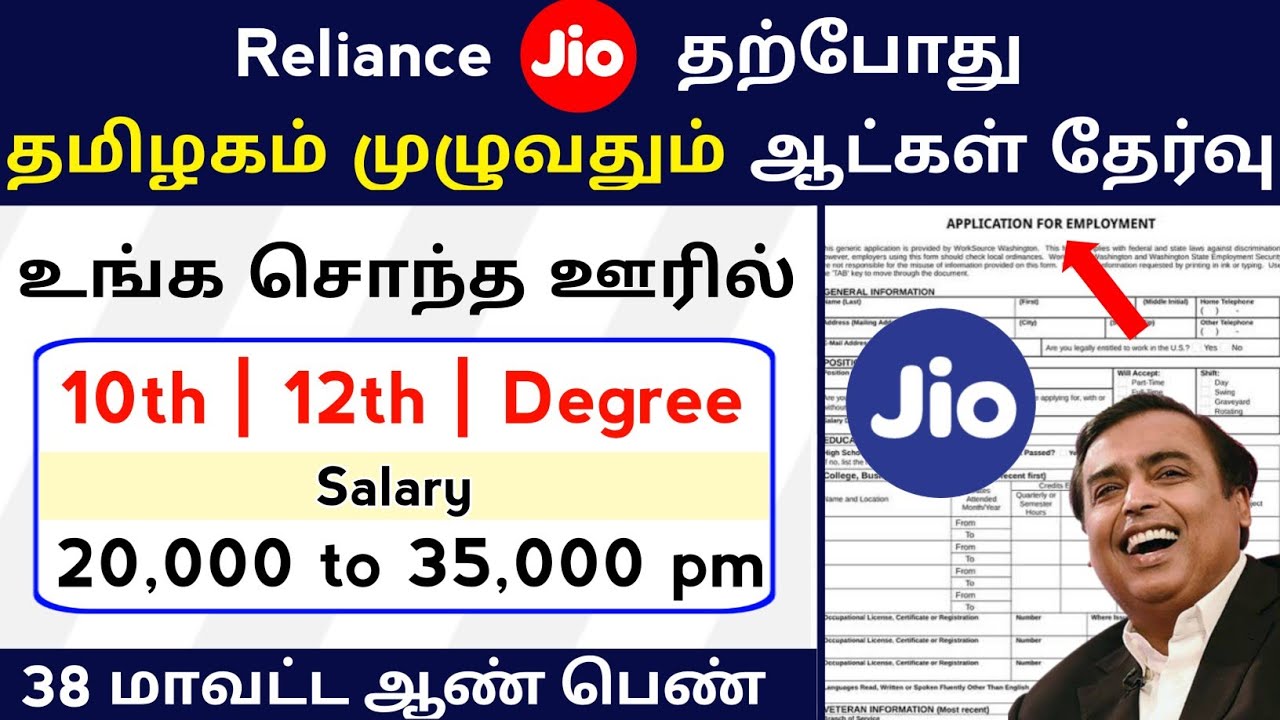

Quick Information About Reliance Bulk Recruitment 2023

| Department Name | Reliance General |

| Category of this Job: | Private Job |

| Reliance Full YouTube Video Link | CLICKHERE |

| Total Vacancies: | Various |

| Name Of The Vacancy: | Associate Agent |

| Place Of Postings: | Anywhere in Tamil Nadu |

| Application starting Date: | 27.06.2023 |

| Application Ending Date: | 05.11.2023 |

| Apply Mode On: | Online Mode ( No Fee ) Apply Very Easy |

Disclaimer:

We share private & Government ( State – Central ) Like job vacancies that appear daily ( peculiar Jobs 20 Post on our site ) Updated Daily accurately and in a way that anyone can understand, and we share full government job details, applications, and job results on our site. Applicants are asked to visit our website daily visit our Website www.saivikramacademy.com Daily and select the positions they are applying for.

Vacancy details for this Job

The Reliance General Insurance Partner Program presents an opportunity for you to become a General Insurance Agent or a POSP (Point of Service Provider) in collaboration with us.

Joining our esteemed pool of commissioning insurance agents is hassle-free, requiring no financial investment or resource utilization.

Moreover, you have the potential to earn a substantial income on a monthly basis.

As a Reliance insurance agent, you can conveniently sell a diverse range of insurance policies including car insurance, two-wheeler insurance, house insurance, health insurance, and travel insurance.

To get started, simply complete the comprehensive 15-hour training program designed by the Insurance Regulatory and Development Authority of India (IRDAI) and successfully clear the subsequent exam.

We also offer additional training to enhance your confidence and proficiency in your commissioning role.

Our user-friendly platform is designed to assist you in becoming an insurance advisor, enabling you to earn a stable and lucrative income.

Once you sign the agreement with our insurance company, you will gain official authorization to directly sell specific insurance products as specified by the company to customers.

Whether you aspire to become a travel insurance agent or specialize in bike insurance, you will have the flexibility to sell any of the general insurance products we offer.

We provide comprehensive training to ensure a smooth and seamless process for you.

Who can become a Reliance General Insurance Partner? Anyone who is at least 18 years old, has completed education up to the 10th standard, and possesses a valid Aadhaar card and PAN card.

Here are a few examples of individuals who can greatly benefit from this program:

Insurance agents play a crucial role in the insurance industry, serving as the bridge between insurance providers and customers. Their primary responsibility is to assist individuals, families, and businesses in obtaining appropriate insurance coverage that suits their specific needs.

This article will delve into the multifaceted world of insurance agents, highlighting their essential functions, skills required, challenges faced, and the evolving landscape of their profession.

I. Defining Insurance Agents Insurance agents are professionals who act as intermediaries between insurance companies and potential policyholders.

They provide personalized guidance, educate clients about available insurance options, and help them select policies that align with their requirements.

Agents can specialize in various types of insurance, such as life, health, property, casualty, and auto insurance, tailoring their services to the specific needs of individuals, families, or businesses.

II. Roles and Responsibilities a. Customer Service and Sales: One of the primary roles of insurance agents is to provide exceptional customer service while driving sales. They assist clients in understanding insurance products, explaining coverage details, and addressing any queries or concerns. By assessing clients’ needs and risk profiles, agents recommend suitable policies and provide quotes, ensuring that customers have adequate protection.

b. Policy Analysis and Customization: Insurance agents carefully analyze clients’ situations and help them customize insurance policies to meet their unique requirements.

They consider factors such as coverage limits, deductibles, and additional riders to tailor policies that align with clients’ budgets and risk tolerance.

c. Claims Assistance: In the event of a claim, insurance agents guide policyholders through the claims process, offering assistance and acting as advocates. They ensure all necessary documentation is completed accurately, helping clients navigate complex procedures and maximizing their chances of a successful claim settlement.

d. Policy Renewals and Updates: Insurance agents maintain ongoing relationships with clients, regularly reviewing their policies and suggesting updates or modifications when necessary. They monitor policy renewals, communicate changes in coverage or terms, and provide continuous support to ensure clients’ insurance needs are met.

e. Market Research and Product Knowledge: Insurance agents stay informed about industry trends, market conditions, and the latest insurance products. They continuously educate themselves on various insurance offerings to provide accurate and up-to-date information to their clients. This knowledge allows agents to offer comprehensive advice and recommend appropriate coverage options.

III. Required Skills and Qualifications a. Strong Interpersonal and Communication Skills: Insurance agents must possess excellent interpersonal and communication skills to establish rapport with clients, understand their needs, and explain complex insurance concepts in a clear and concise manner.

b. Sales and Negotiation Skills: Being able to effectively sell insurance products and negotiate policy terms and rates is essential for insurance agents.

They must be persuasive, confident, and capable of building long-term relationships to generate business and retain clients.

c. Analytical and Problem-Solving Abilities: Agents must analyze clients’ risk profiles, evaluate policy options, and offer appropriate solutions. They need to assess various factors, such as coverage, deductibles, and costs, to make informed recommendations and address clients’ concerns.

d. Ethical Conduct and Trustworthiness: Insurance agents handle sensitive information and must maintain the highest standards of ethics and trustworthiness. They should prioritize clients’ best interests, provide unbiased advice, and handle confidential data responsibly.

e. Technological Proficiency: As the insurance industry becomes increasingly digital, agents must adapt to emerging technologies, such as insurance software, customer relationship management (CRM) systems, and online marketing platforms. Proficiency in using these tools can streamline administrative tasks, enhance customer service, and increase efficiency.

IV. Challenges and Future Outlook Insurance agents face several challenges in their profession, including market competition, regulatory changes, and evolving customer expectations. The rise of online insurance platforms and direct purchasing options has increased competition and necessitated agents to differentiate themselves through exceptional service and expertise. Additionally, changing regulations and compliance requirements require agents to remain updated and adapt their practices accordingly.

However, despite these challenges, the future outlook for insurance agents remains promising. The complex nature of insurance products and the need for personalized advice ensure the continued demand for experienced and knowledgeable agents. As the insurance landscape evolves, agents must embrace technological advancements and adopt a customer-centric approach to remain relevant and thrive in the industry.

Insurance agents are indispensable in helping individuals, families, and businesses navigate the complexities of the insurance industry. Their role extends beyond sales to encompass personalized guidance, claims assistance, policy analysis, and ongoing support. To succeed in this profession, agents must possess a unique combination of interpersonal, analytical, and sales skills. While facing challenges from technological advancements and changing market dynamics, insurance agents can secure their future by leveraging their expertise and adapting to evolving customer needs. As insurance continues to play a vital role in protecting assets and mitigating risks, the importance of insurance agents in the industry remains paramount.

Official Notification & Application Reliance Bulk Recruitment 2023

| Reliance Bulk Recruitment 2023 Apply Direct Link | CLICK HERE |

| Reliance Bulk Recruitment 2023 How To Apply YouTube Video Link | CLICK HERE |

| எப்படி ( RESUME Make ) செய்ய வேண்டும் முழு Video Link 👉 | CLICK HERE |

நீங்க ரொம்ப நாள்ள கேட்ட RESUME எப்படி MAKE செய்ய வேண்டும் Video Link

👉 (RESUME இப்படி இருந்த வேலை தேடி வரும் )👈

| எப்படி ( RESUME Make ) செய்ய வேண்டும் முழு Video Link 👉 | CLICKHERE |

Notification & Application & Study Materials எடுக்கத் தெரியவில்லை என்றால் இந்த வீடியோ பாருங்க 👉👉👇👇 : https://youtu.be/aIJ8nvm8KLw