HDFC Work From Home Jobs In the intricate landscape of financial services, loan review associates play a crucial role in ensuring the stability and profitability of lending operations. Their responsibilities encompass a spectrum of tasks ranging from analyzing loan portfolios to identifying potential risks and ensuring compliance with regulatory standards. This article delves into the multifaceted nature of loan review associate jobs, shedding light on their importance, key responsibilities, required skills, career prospects, and the evolving landscape of this profession.

Loan review associates serve as the guardians of financial integrity within lending institutions. By meticulously assessing loan portfolios, they contribute to risk management efforts, safeguarding the institution against potential losses arising from non-performing loans or inadequate risk mitigation strategies. Their evaluations provide valuable insights to decision-makers, enabling them to make informed choices regarding lending practices and portfolio diversification.

The role of a loan review associate encompasses various responsibilities, including:Portfolio Analysis: Conducting comprehensive reviews of loan portfolios to assess credit quality, adherence to underwriting standards, and overall risk exposure.Risk Identification: Identifying and evaluating potential risks inherent in loan portfolios, such as credit, market, and operational risks.Regulatory Compliance: Ensuring compliance with regulatory requirements and internal policies governing lending practices.Documentation Review: Scrutinizing loan documentation to verify accuracy, completeness, and adherence to legal requirements.Report Generation: Preparing detailed reports summarizing findings from loan reviews and recommending corrective actions where necessary.Collaboration: Collaborating with cross-functional teams, including credit analysts, underwriters, and compliance officers, to address identified issues and implement risk mitigation strategies.

Successful loan review associates possess a diverse skill set, including Analytical Skills: Ability to analyze complex financial data and identify trends, patterns, and anomalies. Attention to Detail: Meticulous attention to detail is essential for accurately assessing loan documentation and identifying potential risks. Risk Management Acumen: Understanding of risk management principles and practices, with the ability to evaluate credit, market, and operational risks.

Regulatory Knowledge: Familiarity with relevant regulatory requirements and guidelines governing lending activities.Communication Skills: Effective communication skills, both written and verbal, are essential for preparing comprehensive reports and collaborating with stakeholders. Problem-Solving Abilities: Aptitude for identifying issues, developing solutions, and implementing corrective actions to mitigate risks. Adaptability: Flexibility to adapt to changing regulatory requirements, market conditions, and organizational priorities.

The demand for skilled loan review associates is expected to remain robust, driven by the ongoing need for effective risk management in financial institutions. Career progression opportunities may include advancement to roles such as senior loan review analyst, credit risk manager, or compliance officer. Additionally, gaining relevant certifications, such as the Certified Credit Risk Professional (CCRP) designation, can enhance career prospects and open doors to higher-level positions within the industry.

The role of loan review associates is evolving in response to technological advancements, regulatory changes, and shifting market dynamics. Automation and data analytics are increasingly being utilized to streamline loan review processes and enhance the efficiency and effectiveness of risk assessments. Moreover, the emergence of new lending products and digital platforms is reshaping the landscape of lending, necessitating continuous adaptation and upskilling among loan review professionals to stay abreast of industry developments.In conclusion, loan review associates play a vital role in maintaining the financial health and stability of lending institutions. Their responsibilities encompass a wide array of tasks, ranging from portfolio analysis to regulatory compliance, requiring a diverse skill set encompassing analytical acumen, attention to detail, and effective communication. As the financial landscape continues to evolve, the role of loan review associates will remain indispensable in ensuring prudent lending practices and mitigating risks in an increasingly complex environment.

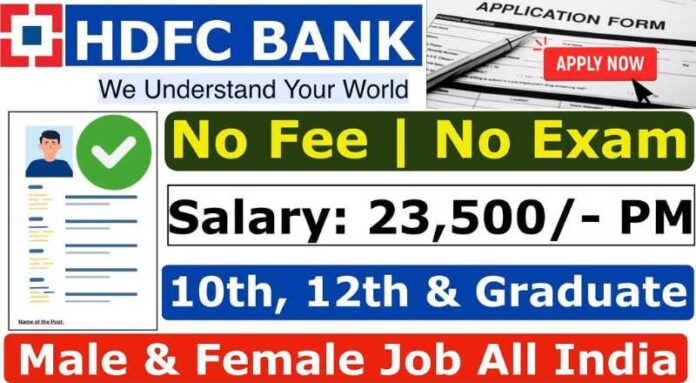

Quick Information About HDFC Work From Home Jobs

| Organization Name: | HDFC |

| Job Category: | Bank Jobs |

| Employment Type: | Work From Home Basis |

| Name of Vacancies: | Financial Consultant |

| Place of Posting: | All Over India |

| Starting Date: | 07.04.2024 |

| Last Date: | 27.05.2024 |

| Apply Mode: | Online |

Disclaimer:

We share private & Government ( State – Central ) Like job vacancies that appear daily (peculiar Jobs 20 Post on our site ) Updated Daily accurately and in a way that anyone can understand, and we share full government job details, applications, and job results on our site. Applicants are asked to visit our website

Vacancy details for this Job HDFC Work From Home Jobs

Opportunity Beckons: HDFC Life Recruitment for Digital Financial Consultants

In today’s dynamic job market, opportunities are often fleeting. However, if you meet the eligibility criteria outlined below, an exciting chance awaits you to secure a rewarding position as a Digital Financial Consultant. Take action without delay; delve into the details provided here and seize the opportunity by applying promptly.

Eligibility Criteria

If you fulfill the following eligibility criteria, you are eligible to apply for the positions on offer and stand a chance to secure a promising role:

Organization Offering the Jobs

HDFC Life, a distinguished organization in our nation renowned for its excellence in digital financial consultancy, is conducting a significant recruitment drive.

Job Details

The vacancies pertain to the role of Digital Financial Consultant, underscoring the organization’s commitment to digital innovation in the financial sector.

Qualifications Required

To be considered for these positions, candidates must possess qualifications equivalent to 10th/10+2/Any Degree. Remarkably, prior experience is not a prerequisite, making these opportunities accessible to both freshers and seasoned professionals alike.

Age Limit

Prospective applicants must be a minimum of 18 years old, in accordance with the age requirements stipulated by major organizations in our country, rendering them eligible to apply for these coveted positions.

Work Description

In the capacity of a Digital Financial Consultant, you will engage digitally with designated Relationship Managers. Communication channels will include toll-free numbers and emails, facilitating seamless interaction. Furthermore, training and development sessions will be conducted virtually, enabling you to enhance your skills remotely.

Salary Details

Successful candidates can anticipate a competitive monthly salary of ₹30,000/-, complemented by an array of additional benefits extended by the company.

How to Apply

The application process is straightforward. Visit the company’s official website, complete the application form with accurate details, and promptly submit it for consideration.

Selection Process

Following the submission of applications, the selection process will entail:

- Written tests

- Interviews

- Document verification preceding the issuance of job offers.

In conclusion, this recruitment drive by HDFC Life presents a golden opportunity for aspiring individuals to embark on a rewarding career journey as Digital Financial Consultants. Don’t let procrastination deter you; seize the moment by submitting your application promptly and setting the wheels of your professional aspirations in motion.

HDFC Bank, one of India’s leading financial institutions, offers a myriad of career opportunities, with the role of Financial Consultant standing out as a key position within its workforce. This article delves into the responsibilities, skills, and opportunities associated with being an HDFC Bank Financial Consultant.

Understanding the Role: Financial Consultants at HDFC Bank play a pivotal role in assisting clients with their financial needs and goals. They act as advisors, guiding individuals and businesses in making informed decisions about investments, savings, loans, and insurance products offered by the bank.

Responsibilities:

- Financial Planning: Financial Consultants assess clients’ financial situations and develop comprehensive plans to help them achieve their short-term and long-term financial objectives.

- Client Relationship Management: Building and maintaining strong relationships with clients is crucial. Consultants must understand clients’ needs, preferences, and risk tolerance to provide personalized financial advice.

- Product Knowledge: Being well-versed in HDFC Bank’s diverse range of financial products is essential. Consultants should have in-depth knowledge of various investment options, insurance plans, and banking services.

- Sales and Revenue Generation: Financial Consultants are responsible for meeting sales targets by recommending suitable financial products to clients and persuading them to make investments or purchase insurance policies.

- Compliance and Regulation: Adhering to regulatory guidelines and ensuring compliance with legal requirements is paramount. Consultants must stay updated on industry regulations and maintain ethical standards in their interactions with clients.

Skills Required:

- Financial Acumen: A strong understanding of financial concepts, including investment strategies, risk management, and taxation, is essential.

- Communication Skills: Effective communication skills are crucial for building rapport with clients and explaining complex financial concepts in a clear and concise manner.

- Analytical Abilities: Financial Consultants must possess strong analytical skills to assess clients’ financial situations, evaluate investment opportunities, and formulate suitable recommendations.

- Sales and Negotiation Skills: The ability to persuade and negotiate is vital for meeting sales targets and convincing clients to make financial decisions aligned with their goals.

- Ethical Conduct: Upholding ethical standards and maintaining client confidentiality are integral aspects of the role.

Career Opportunities: Working as a Financial Consultant at HDFC Bank offers numerous opportunities for career advancement and professional growth. Successful consultants may have the chance to take on leadership roles, such as Senior Financial Consultant or Branch Manager, overseeing larger teams and expanding their responsibilities. Additionally, HDFC Bank provides ongoing training and development programs to enhance employees’ skills and knowledge, ensuring they stay abreast of industry trends and best practices.

Becoming an HDFC Bank Financial Consultant is not just a job; it’s a fulfilling career path that offers the opportunity to make a meaningful impact on clients’ financial well-being. With the right blend of skills, dedication, and commitment to excellence, individuals can thrive in this dynamic and rewarding role, contributing to both their own professional success and the success of HDFC Bank as a trusted financial institution.

HDFC Work From Home Jobs Full Video Link : CLICK HERE

Official Notification & Application HDFC Work From Home Jobs

| HDFC Work From Home Jobs Official Website Link | CLICK HERE |

| HDFC Work From Home Jobs Official Notification Link | CLICK HERE |

| HDFC Work From Home Jobs Official Apply Link | CLICK HERE |

HERE YOU CAN JOIN OUR SAI VIKRAM ACADEMY FAMILY

| SAIVIKRAM ACADEMY YOUTUBE CHANNEL | WHATSAPP GROUP |

| TELEGRAM GROUP | FACEBOOK PAGE LINK |

| Instagram Account Link |

sai vikram academy , saivikramacademy , tamilnadu employment seniority list 2024 , employment seniority list 2024 , sai vikram academy work from home , employment seniority list 2024 pdf , tamilnadu cooperative training admission 2023-24 , sai vickram academy , tnpsc group 4 study plan in tamil pdf , sai vikram academy work from home writing jobs , tamil nadu employment seniority list 2024 , sai vikram academy whatsapp group link , employment website news , sri vikram academy , sai vikram academy work from home jobs , tnpsc group 4 study plan pdf , saivikram academy , tnpsc group 4 study plan 2024 , handwriting jobs work from home without investment 2023 , group 4 study plan 2024 , vikram academy , sai vikram academy job vacancy , pepul career work from home , jio hotstar jobs work from home , tamilnadu cooperative training admission 2023-24 pdf , tamilnadu employment seniority list 2024 pdf download , tamilnadu cooperative training admission 2023 24 pdf last date , sai vikram academy contact number , sai vikram academy.com , sai Vikram , sai vikram academy fake or real , sai vikram academy reviews , atm officer recruitment 2024 , tnpsc group 4 study material pdf , sai vikram academy , tech mahindra news , how to check employment seniority list , sri sai vikram academy , kvb bank job vacancy 2024 ,